Performance & return

Since its market launch in August 2018, the IDS system has consistently delivered above-average returns – regardless of whether the markets rise or fall.

The historical performance shows: The IDS system not only achieves higher returns than traditional index funds (ETFs), but does so with shorter recovery phases and fewer setbacks.

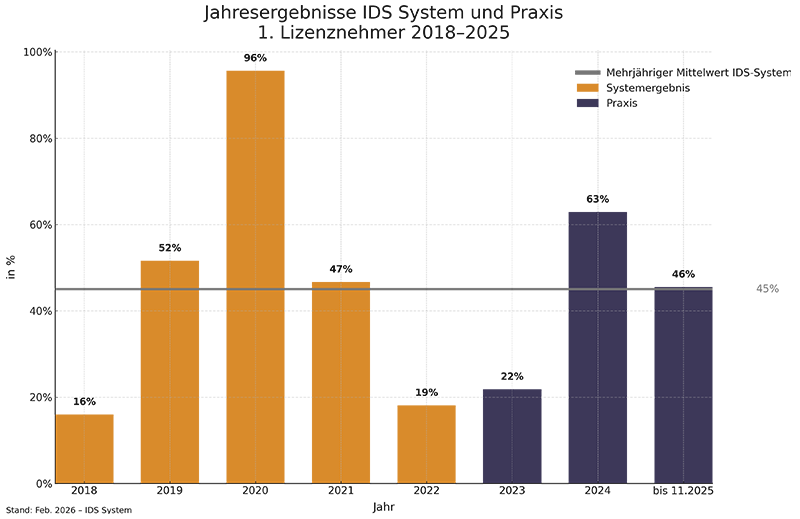

IDS system and practice

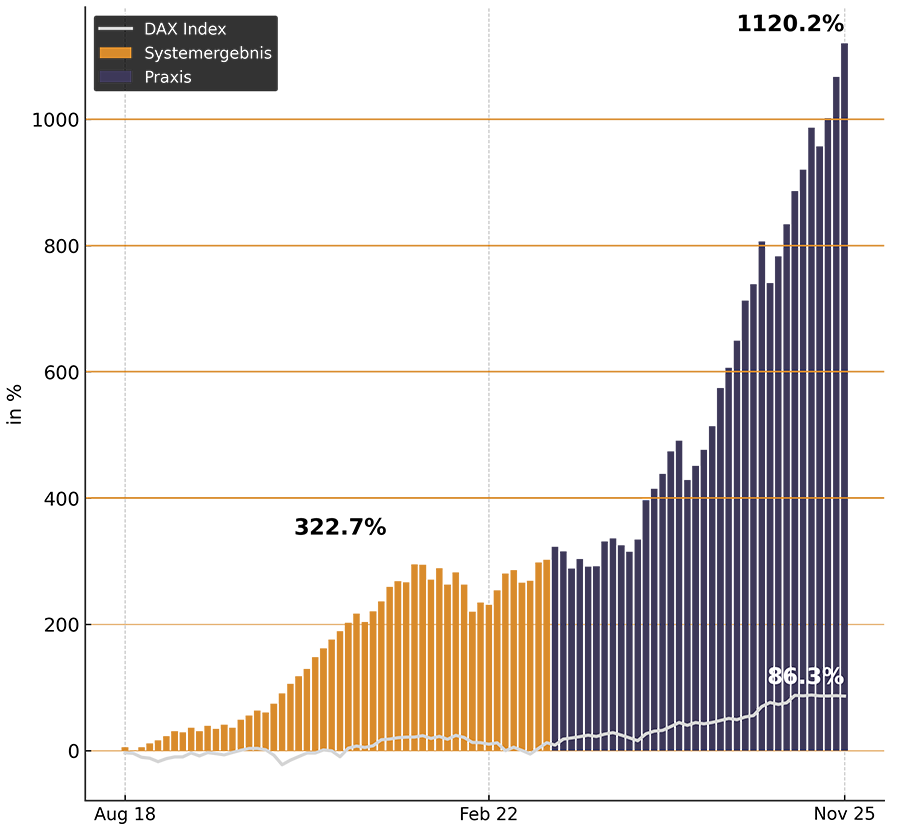

The IDS effect: sustainable superiority over the market

The graph impressively illustrates the so-called IDS effect: the IDS system achieves a significantly higher performance than the DAX index – both in long-term system operation and in practical application. While the DAX shows strong fluctuations and longer sideways phases over the period, the IDS System shows a continuously positive development with stable growth.

What is the IDS effect?

The IDS system is based on a unique, rule-based trading strategy. This ensures that losses are limited through consistent risk management, while opportunities on the market are exploited in a targeted manner. The result: fewer setbacks in difficult market phases, steady growth and a significant outperformance compared to the market as a whole.

Summary:

The IDS effect stands for sustainable, predictable investment success and makes the difference to traditional index investments visible. Professional and private investors benefit from a modern, future-oriented investment solution.

vs. IDS practice from 01/23 to 01/2026 (blue)

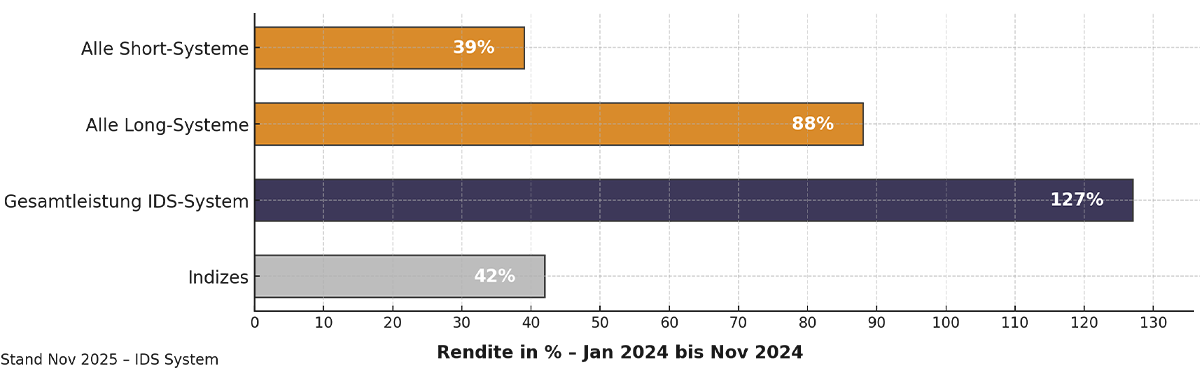

Systematic outperformance

Sources of income:

Long components (rising markets) +99.6 %, short components (falling markets) +53.8 % → Total: +153.4 % (Jan 2024 – Jan 2026)

Not a single year of losses since August 2018 – not even in extreme market phases such as the 2020 coronavirus crisis

system diversity:

32 sub-semisystems, 2,304 main variants, over 1.2 billion possible combinations

replicability:

All decisions are based exclusively on actual price movements – no opinions, no forecasts

Maximum flexibility - thanks to system diversity

The IDS system is based on 32 sub-half systems and over 2,300 tradable main variants. A customized system variant can be selected for each investor based on their individual risk preference.

- Individual determination of the yield potential

- Limiting the extent and duration of price setbacks

- Targeted selection of the underlying indices (e.g. DAX, Dow, S&P 500, Nasdaq 100)

The result: an exceptionally efficient trading system with predictable returns and controllable risk – for professional investors and discerning investors.