Stock market success without future knowledge - innovative, rule-based, replicable

IDS System AG has developed a globally innovative trading system that differs fundamentally from traditional index funds (ETFs).

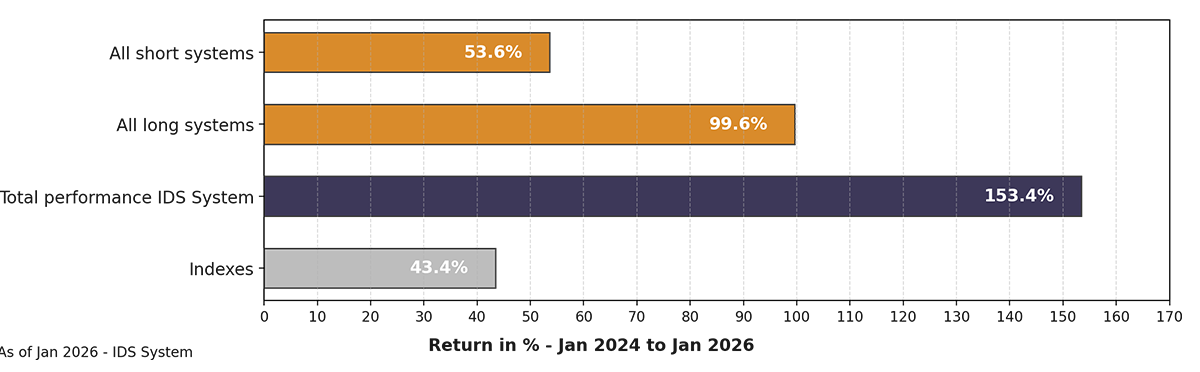

The so-called IDS system generates returns both when prices rise and fall – completely independently of market opinions or forecasts.

The difference: system instead of speculation

Market dependency

Risk management

Strategy diversity

Responsiveness

Only effective in rising markets

Not individually controllable

Simple index mapping

Passive, standardized

Profitable even in falling markets

Control of setback height & recovery time possible

2,304 combinable main system variants

Active, rule-based, customizable

What makes the IDS system so special?

Rule-based instead of speculative:

Decisions are based exclusively on actual price movements. Opinions, balance sheets or analyst assessments play no role.Double sources of return – long & short simultaneously:

Active subsystems trade in both directions simultaneously.

Returns in both rising and falling prices.Maximum system diversity for individual customization:

There are currently 32 sub-half systems, 2,304 main variants and over 1.2 billion possible combinations available.

Users can select the right strategy from these – adapted to their return target, risk tolerance and preferred indices.Recalculable & replicable since 1999:

All system variants can be recalculated back to 1999. This creates maximum transparency and reliability in planning.Proven superiority over index funds:

The IDS system has achieved a cumulative return of +1,204 % (40.8 % p.a.) since 2018

In the same period: DAX only +91.6% (9.1 % p.a.)

Performance better than the market - system-related

The IDS system does not outperform traditional indices by chance, but by design.

Since 2018, the IDS system has achieved a significantly higher return than the DAX, S&P 500 or Nasdaq year after year – with shorter recovery phases and fewer setbacks at the same time